RealWear, a Vancouver, Wash.-based firm that sells industrial hands-free wearable “assisted actuality” headsets, goes public through a SPAC cope with Seattle-based Cascadia Capital.

The deal, introduced Monday, will worth the brand new mixed firm at $375.5 million.

RealWear sells ruggedized head-mounted voice-controlled gadgets that challenge a digital Android pill just under line of sight. Industrial employees use the product to do distant video calling, doc navigation, guided workflow, cell varieties, and knowledge visualization, amongst different duties. The corporate lately launched an accompanying RealWear Cloud Platform to handle gadgets and knowledge.

The idea of an augmented actuality heads-up show hasn’t but reached mainstream customers however RealWear carved a distinct segment with greater than 5,000 enterprise prospects reminiscent of Siemens, Johnson & Johnson, Ford, and others. It counts 41 of the Fortune 100 as purchasers and has deployed greater than 70,000 items.

The corporate reported $20.5 million in 2022 income, up from $13.9 million in 2019, in line with an investor presentation made public Monday. Its gross margin was 63% in 2022.

The deal, anticipated to shut within the second half of 2023, combines RealWear with Cascadia Acquisition Corp., a particular goal acquisition firm led by Seattle funding financial institution Cascadia Capital.

Cascadia beforehand mentioned it was focusing on an organization within the robotics and AI house, and had set a February 2023 deadline to get a deal achieved.

Often known as clean test firms, SPACs re-emerged in a giant method through the pandemic as capital flowed to newly shaped entities and entrepreneurs used the monetary devices to extra shortly enter the general public markets.

However the efficiency of post-merger SPACs steadily dropped all through 2022 amid the bigger market slowdown and a number of other offers have been spiked.

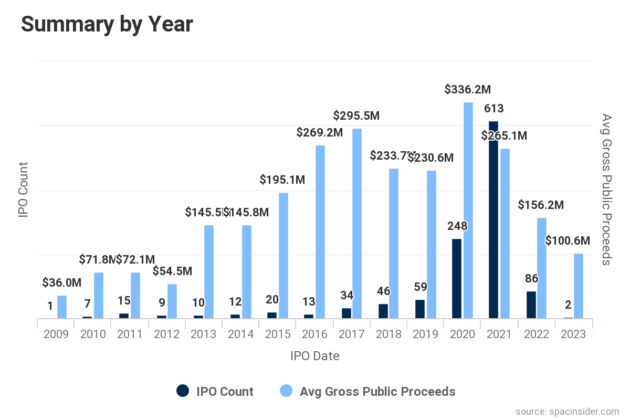

There have been simply 86 SPAC IPOs in 2022, in comparison with 613 in 2021, in line with SPACInsider. The median post-merger firm that debuted in 2022 misplaced 70% of its worth, Bloomberg reported.

4 Seattle-area firms went public through SPAC final 12 months — Porch, Nautilus Biotechnology, Rover, and Leafly — and their shares have fallen sharply.

Solely two firms have gone public to date in 2023 through a SPAC.

Cascadia’s Jamie Boyd, who led the agency’s SPAC as CEO, expressed optimism again in Might {that a} deal would get achieved. “We’re completely believers on this,” Boyd instructed Startup in Pittsburgh, the place Cascadia hosted a robotics and AI convention.

Cascadia’s SPAC ambitions are distinctive in that the agency has historically helped healthcare, retail, expertise and different firms discover patrons. Final 12 months Cascadia raised greater than $50 million in a novel deal to broaden its providers.

Based in 2016, RealWear has raised greater than $120 million up to now, together with a $23.5 million Collection C spherical in June from Foundry Group, Qualcomm Ventures, Kopin, and Columbia Ventures Company. It raised a $80 million Collection B spherical in July 2019. Different backers embrace Bose, Teradyne, Kopin Company, and JP Morgan Chase.

RealWear is led by chairman and CEO Andrew Chrostowski, former president of Scott Security who held exec roles at UTC Aerospace Methods, Goodrich, Energizer, Pfizer, and Hitachi.

Along with Boyd and Cascadia Chairman Michael Butler, administrators of Cascadia Acquisition Corp. embrace Edgar Lee, a former government at Oaktree Capital Administration; Scott Prince, CEO of APS Logistics Holdco; and Arun Venkatadri, a senior product supervisor at Aurora who beforehand labored at Uber and Lyft and based Extremis Ventures.

“CCAI was established with the intention of figuring out and partnering with companies which can be using expertise and innovation to disrupt business in sizable and increasing markets,” Boyd mentioned in an announcement Monday. “RealWear completely matches these standards, and we’re thrilled to companion with them and add worth by strengthening their monetary place in pursuit of development initiatives throughout product, buyer, geography and business initiatives.”